New home construction was in full swing throughout 2019, especially in rural Halifax. Construction began on 872 single-unit houses, exceeding 2018’s figure by 143 units (20% growth) and outpacing the 10-year average by 126 units. Most of these starts were in rural Halifax, where the construction of single-unit housing has nearly doubled over the last 5 years. Construction on single-unit housing slowed in both urban and suburban regions in 2019.

Construction on multi-unit housing reached a new record in 2019 with work beginning on 2,271 new units. Of these, 91% were apartment-style housing, 7% were row-housing, and the remaining 3% were semi-detached. Multi-unit starts grew by 25% in rural regions and 16% in the suburbs, while falling by 26% on the peninsula. The 957 multi-units started in rural Halifax through 2019 set a new annual record for multi-units in rural regions.

Increasing the pace of housing construction helps to keep prices low and is especially important given the increase in demand resulting from our rapid population growth over the last 5 years.

Rental supply has not kept up with demand despite more apartment buildings being under construction than ever before. As a result, apartment vacancy rates declined sharply over the last 5 years, reaching a record low of 0.9% vacancy for 2-bedroom apartments in 2019. According to the Canada Mortgage and Housing Corporation (CMHC), apartment vacancy rates are lowest in the Peninsula South, Bedford, and Rural regions of Halifax. Monthly rent also rose by 4.0% in 2019, bringing the average rent for a 2-bedroom apartment up to $1,202 per month (+$46 over 2018).

Home ownership has not experienced the same demand pressures as rental properties in recent years. The average price of a new single-detached house in Halifax was $463,843 in 2019 – half the national average. Among the 6 benchmark cities, Halifax remains the third most affordable place to purchase a new single-detached home and the fourth most affordable to purchase a resale home.

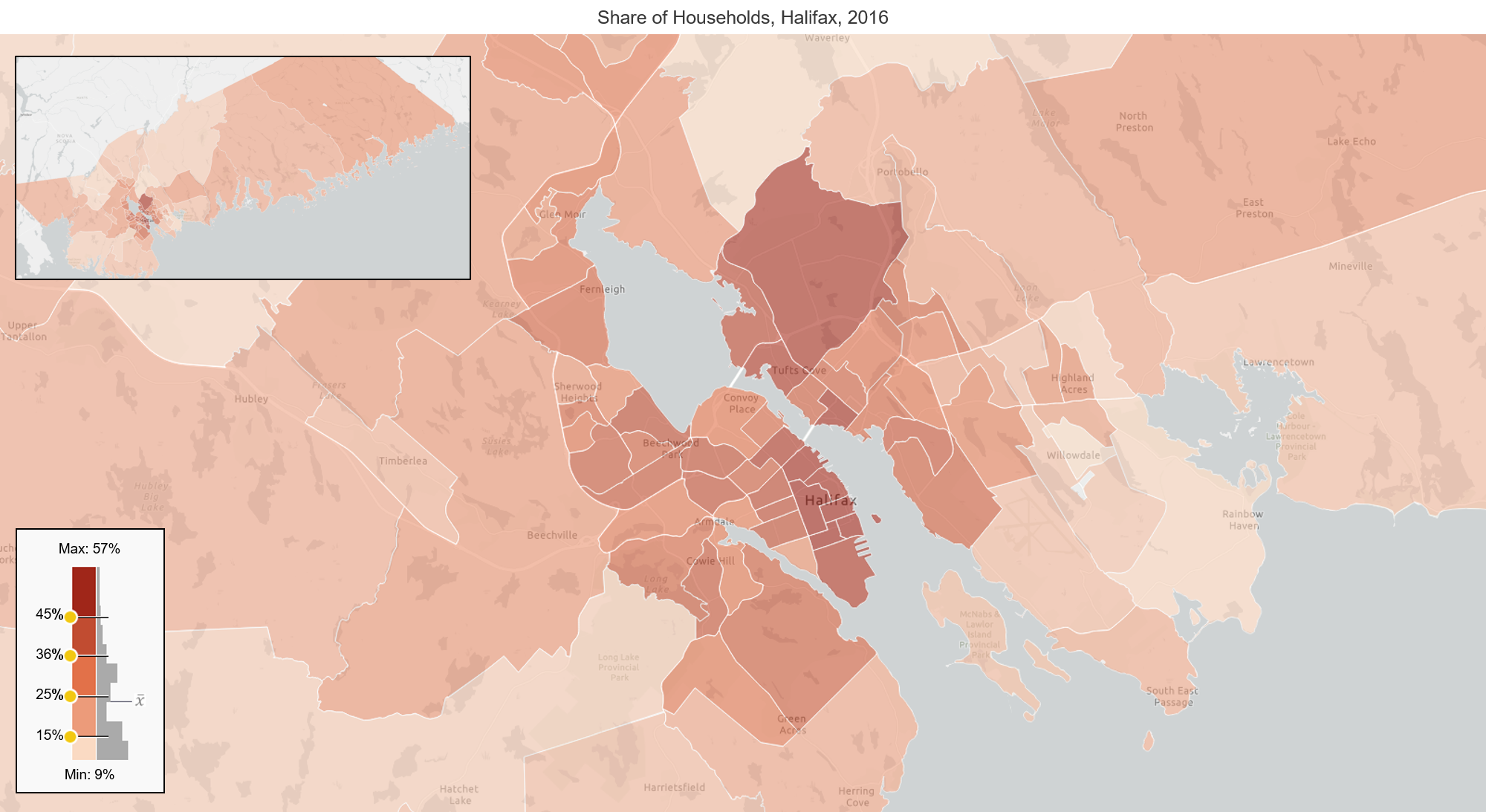

A measure often used to assess housing affordability is the shelter-cost-to-income ratio. Using data from the 2016 census, we can look at various regions in Halifax to understand where affordability pressures are the highest. Overall, one-quarter of all households spend more than 30% of their income on shelter. Housing affordability pressures are most acute in and around the downtown and less acute in rural regions.